SST in Malaysia and How It Works. The Sales and Service Tax SST is made up of two main taxes.

Architecture And Urban Design Portfolio Landscape And Urbanism Landscape Architecture Graphics Architecture

Sales and Service Tax SST is a tax charged and levied on taxable services provided by the taxable person.

. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back. With the SST discount ending how will new car sales fare. Businesses in Malaysia have a relatively short period in which to adjust to the new process so its best they work with a local.

A service tax on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single stage sales tax levied on imported and locally manufactured goods either at the time of importation or at the time of sale respectively. The service tax rate will be 6. It stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministry.

The current threshold is set at an amount of RM500000. Preparing for GST audit. Sales tax is a single-stage tax system.

Rate could go up to 35 in the whole of 2019. Understanding the SST implementation mechanism. It is a single-stage tax which means that an amount is charged on taxable goods which are manufactured and sold by any taxable person s in the country.

Malaysia will bring in a sales and services tax SST in September 2018 to replace the unpopular goods and services tax GST. A single tax levied on imported and locally made goods. Goods will be taxed between 5 and 10 under the new SST while services are taxed at 6.

SST was reinstated on 1 September 2018 the tax. I The SST will be a single-stage tax where the sales ad. A SST registered manufacturer selling goods locally or a company importing taxable goods into Malaysia will be subjected to this Sales Tax.

Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. Taxable service is any service which prescribed to be a taxable service. Exempted from SST registration are tailoring jewellers and opticians.

Objective of Understanding Malaysian Sales and Service Tax training. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. It is either imposed during the time of importation or goods disposal or sales.

Understand the different between GST and SST and the impact on your business. Markets and industries leader at Deloitte Malaysia. Taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person.

The announcement was made just yesterday and already there is a lot of negative social media attention on this retirement of the sales tax discount that has been in play for the past 24 months it was first announced in June 2020 to revive the fledgling auto industry. Sales tax and service tax which we will be mentioning later in the article. Understanding the concept and scope of SST.

The Services Tax is an indirect tax which is imposed on any taxable service which has been provided by a taxable individual in Malaysia and was provided in the name or with the approval of a company. Currently stands at 325. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question.

The new SST system dubbed SST 20 is much simpler for businesses compared with the previous Goods and Services Tax GST regime it replaced and the old SST framework that preceded GST. Current sales tax is at 5 for basic foodstuff fruit juices computers mobile phones and watches and 10 for all other goods except petroleum. Two components of the SST are charged and levied.

Aware and understand the various Exemption Benefits and Facilities. The threshold for operators of restaurants cafes bars canteens or any food and beverage business is subject to RM 1500000. The Sales Tax is a single-stage tax which is imposed at import and production levels.

The new sales tax will be imposed at a rate of either 5 10 or a specific amount will be for petroleum products. However SST works separately as Sales Tax and Service Tax. Nevertheless under the new SST the number of goods exempted from the tax is much more compared to that of GST.

In Malaysia Sales and Service Tax SST is a consumption tax imposed on a wide range of goods and services. The businesses that perform their activities in Malaysia and internationally will have to pay SST if they exceed a particular annual income threshold. Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and requiring Malaysian businesses to adjust to a new regime.

Until SST is re-introduced in a revised structure the GST has been zero rated. This means that while businesses will still have to do the compliance work around. Here are the details on how the SST works - the registration process returns and payment of the SST and the transitional measures to take after the abolishment of the GST.

A What is Service Tax.

Seatguru Seat Map Virgin Atlantic Boeing 787 900 789 Seatguru Seatguru Hong Kong Airlines Seating Charts

36 Square Black Laminate Table Top With 30 X 30 Bar Height Table Base Bar Height Table Laminate Table Top Modern Bar Table

Tealive Ramadan Promotion Drink Rm5 From 13 April 2021 Until 12 May 2021 Ramadan Banner Ads Design Promotion

Thank You Staff Motivation Thank You Training Center

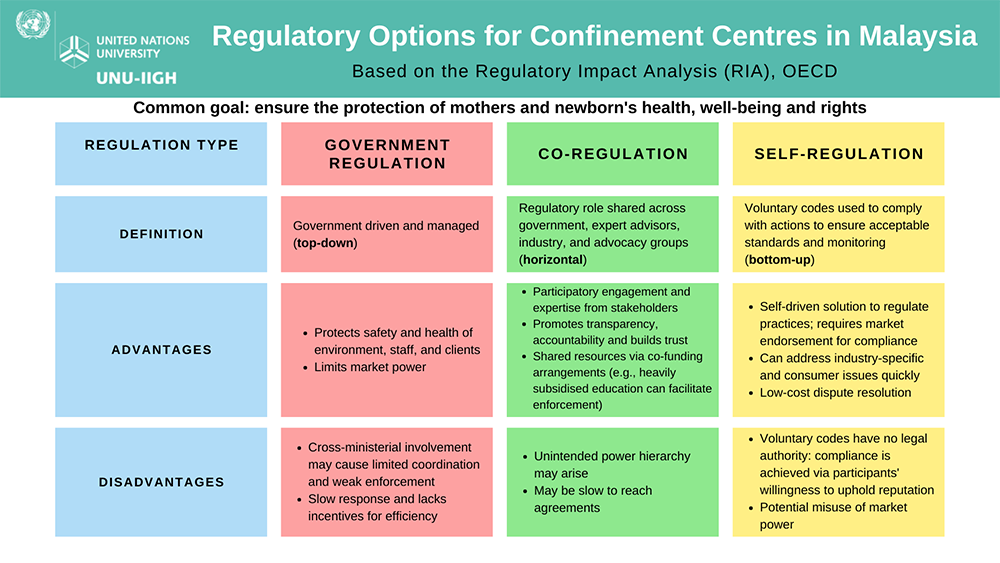

Confinement Centres In Malaysia Addressing The Challenges Of Providing The Best Care For Mothers And Newborns International Institute For Global Health

Introduction To Fxfactory User Manual Pinterest Final Cut Pro

Men S Shirt Unique Shirts Men Mens Designer Shirts Shirts

Country Names List Country Name List Country Names World Country Names

K Mark Heavy Duty Safety Shoes Safety Shoes Boots Up Shoes

New Model Toyota Hilux 2020 Price Philippines Redesigns Toyota Hilux New Ford Mustang Toyota

No Sth But I Will Take These Comic Book Cover Mini Cars Book Cover

Autocount Accounting Software Malaysia Financial Budget Budgeting Business